Modern money and the escape from austerity

Renewal - Print ISSN 0968-5211 - Online ISSN

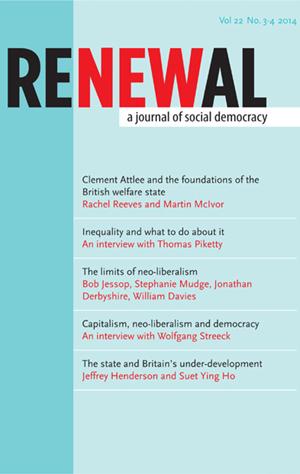

Volume 22 Number 3-4 (2014)

Modern money and the escape from austerity

Joe Guinan

Abstract

Modern monetary theory destroys the intellectual basis for austerity but needs a more robust political economy.

On 2 January 1879 the United States returned to the gold standard. Specie payments had been quietly suspended in 1861 to meet the costs of the Civil War, with Congress authorising the issuance of $450 million in ‘greenbacks’ – legal tender treasury notes – that greatly increased commercial liquidity and triggered an economic boom. But with wartime exigencies over, banking interests demanded a return to financial propriety and redeemable hard money. ‘Though the Civil War had been fought with fifty-cent dollars’, historian Lawrence Goodwyn explained, ‘the cost would be paid in one-hundred-cent dollars. The nation’s taxpayers would pay the difference to the banking community holding the bonds’ (Goodwyn, 1978, 11). What followed was one of the most extraordinary and creative episodes in the history of popular democratic understanding of money.

The constriction of the US money supply caused a deflationary spiral; as population and production increased but the availability of money was held constant, prices fell. Farmers were hit particularly hard. The narrow organisation of capital markets around an inflexible gold-based currency meant annual panics during the financial squeeze prompted by the autumn harvest. The brutal crop-lien system delivered increasing numbers over to the furnishing merchants and chattel mortgage companies, as farmers were forced to take on ever more debt that would have to be paid off in an appreciating currency.

To cite this article

Joe Guinan (2014) Modern money and the escape from austerity, Renewal, 22(3-4 )